- Research

- Open access

- Published:

Arbitrage-free pricing of derivatives in nonlinear market models

Probability, Uncertainty and Quantitative Risk volume 3, Article number: 2 (2018)

Abstract

The objective of this paper is to provide a comprehensive study of the no-arbitrage pricing of financial derivatives in the presence of funding costs, the counterparty credit risk and market frictions affecting the trading mechanism, such as collateralization and capital requirements. To achieve our goals, we extend in several respects the nonlinear pricing approach developed in (El Karoui and Quenez 1997) and (El Karoui et al. 1997), which was subsequently continued in (Bielecki and Rutkowski 2015).

1 Introduction

The paper contributes to the nonlinear arbitrage-free pricing theory, which arises in a natural way due to the salient features of real-world trades, such as: trading constraints, differential funding costs, collateralization, counterparty credit risk, and capital requirements. Our aim is to extend in several respects the nonlinear hedging and pricing approach developed in El Karoui and Quenez (1997) and El Karoui et al. (1997) who used a BSDE approach, by accounting for the complexity of over-the-counter financial derivatives and specific features of the trading environment after the global financial crisis. This work builds also upon the earlier paper by (Bielecki and Rutkowski 2015) where, however, the important issue of no-arbitrage was not studied in depth. The paper is structured as follows:

-

In Section 2, we introduce the self-financing trading strategies in the presence of differential funding rates and adjustment processes. We consider general contracts with cash flow streams, rather than simple contingent claims with a single payoff either at the contract’s maturity or upon early exercise. We also introduce in Section 2.9 the concepts of local and global valuation problems. This distinction is crucial since it demonstrates that results obtained in Sections 3 and 4 are capable of covering also financial models and valuation problems that cannot be addressed through classical BSDEs, which are nowadays commonly used to deal with nonlinear financial markets.

-

Section 3 is devoted to a comprehensive examination of the issue of existence of arbitrage opportunities for the hedger and for the trading desk in a nonlinear trading framework and with respect to a predetermined class of contracts. We introduce the concept of no-arbitrage with respect to the null contract and a stronger notion of no-arbitrage for the trading desk. We then proceed to the issue of unilateral fair valuation of a given contract by the hedger who is endowed with an initial capital. We examine the link between the concept of no-arbitrage for the trading desk and the financial viability of prices computed by the hedger.

-

In Section 4, we propose and analyze the concept of a regular market model, which can be seen as an extension of the notion of a nonlinear pricing system, which was introduced by (El Karoui and Quenez 1997). The goal is to identify a class of nonlinear market models, which are arbitrage-free for the trading desk and, in addition, enjoy the desirable property that if a given contract can be replicated, then the cost of replication is also the fair price for the hedger.

-

Section 5 focuses on replication of a contract in a regular market model. We propose four alternative definitions of no-arbitrage prices, namely, the gained value, the ex-dividend price, the exit price, and the offsetting price. Generally speaking, it is not expected that these prices will coincide, since they correspond to different valuation problems for the hedger. However, when the trading arrangements in the underlying model are such that the valuation problem is local then, under some suitable technical conditions, we show that the gained value and the ex-dividend price coincide.

-

In Section 6, we present a BSDEs approach to the valuation and hedging and derive examples of BSDEs for the gained value and the ex-dividend price. Finally, we briefly address in Section 7 the issue of the so-called valuation adjustments in linear and nonlinear market models and we make some comments on the prevailing market practice of separation of ‘clean price’ from the ‘total valuation adjustment’.

Although we focus on the issue of fair unilateral valuation from the perspective of the hedger, it is clear that identical definitions and valuation methods are applicable to his counterparty as well. Hence, in principle, it is possible to use our results to examine the interval of fair bilateral prices in a regular market model. Particular instances of such unilateral and bilateral valuation problems were previously studied in Nie and Rutkowski (2015, 2016a, 2017 (published online on 18 April 2017)) where it was shown that a non-empty interval of either fair bilateral prices or bilaterally profitable prices can be obtained in some nonlinear models for contracts with either an exogenous or an endogenous collateralization. It should be acknowledged that there exists a vast body of literature devoted to valuation and hedging of financial derivatives under differential funding costs, collateralization, the counterparty credit risk and other trading adjustments (see, for instance, Bichuch et al. (2018), Brigo and Pallavicini (2014), Brigo et al. (2018, 2017), Burgard and Kjaer (2011, 2013), Crépey (2015a, b), Mercurio (2013), Pallavicini et al. (2012b, a), and Piterbarg (2010). In view of limited space, we cannot present here these works in detail. Let us only mention that most of these papers deal with linear market models of credit risk (possibly also with differential funding rates), whereas the general theory developed in this work aims to address problems where the emphasis is put on a nonlinear character of valuation in market models with imperfections. In contrast, Albanese et al. (2017), Albanese and Crépey (2017), and Crépey et al. (2017) propose to address the issue of valuation adjustments through an alternative approach, which is based on the global valuation paradigm referencing to the balance sheet of the bank, its internal structure, and long-term interests of bank’s shareholders. The issue of nonlinearity of trading does not appear in their approach, since the classical hedging arguments are no longer employed to determine the value of a new contract, which is added to the existing portfolio of bank’s assets. For further comments on some of the above-mentioned papers, we refer to Section 7.

2 Nonlinear market model

We start by re-examining and extending the nonlinear trading setup introduced in Bielecki and Rutkowski (2015). Throughout the paper, we fix a finite trading horizon date T>0 for our market model. Let \((\Omega, \mathcal {G}, \mathbb {G}, \mathbb {P})\) be a filtered probability space satisfying the usual conditions of right-continuity and completeness, where the filtration \(\mathbb {G}=(\mathcal {G}_{t})_{t \in [0,T]}\) models the flow of information available to the hedger and his counterparty. For convenience, we assume that the initial σ-field \({\mathcal {G}}_{0}\) is trivial. All processes introduced in what follows are implicitly assumed to be \(\mathbb {G}\)-adapted and, as usual, any semimartingale is assumed to be a càdlàg process. Let us introduce the notation for the prices of all traded assets in our model.

Risky assets. We denote by \(\mathcal {S}=\left (S^{1},\ldots,S^{d}\right)\) the collection of the ex-dividend prices of a family of d risky assets with the corresponding cumulative dividend streams\(\mathcal {D} =\left (D^{1},\ldots, D^{d}\right)\). The process Si represents the ex-dividend price of any traded security, such as, stock, sovereign or corporate bond, stock option, interest rate swap, currency option or swap, credit default swap, etc.

Funding accounts. We denote by Bi,l (resp. Bi,b) the lending (resp. borrowing) funding account associated with the ith risky asset, for i=1,2,…,d. The financial interpretation of these accounts varies from case to case. For an overview of trading mechanisms for risky assets, we refer to Section 2.6. In the special case when Bi,l=Bi,b, we will use the notation Bi and we call it the funding account for the ith risky asset.

Cash accounts. The lending cash account B0,l and the borrowing cash account B0,b are used for unsecured lending and borrowing of cash, respectively. For brevity, we will sometimes write Bl and Bb instead of B0,l and B0,b. Also, when the borrowing and lending cash rates are equal, the single cash account is denoted by B0 or, simply, B. Note, however, that since an unlimited borrowing/depositing of cash in the bank account is not a realistic feature of a trading model, it is not assumed in what follows.

For brevity, we denote by \(\mathcal {B} =(B^{i,l},B^{i,b},\ i=0,1,\ldots,d)\) the collection of all cash and funding accounts.

2.1 Contracts with trading adjustments

We will consider financial contracts between two parties, called the hedger and the counterparty. In what follows, all the cash flows will be viewed from the prospective of the hedger, with the convention that a positive cash flow means that the hedger receives the corresponding amount, and a negative cash flow meaning that the hedger makes a payment. A bilateral financial contract (or simply a contract) is given as a pair \(\mathcal {C}=(A,\mathcal {X})\), where the meaning of each term is explained below.

A stochastic processes A represents the cumulative cash flows from time 0 till the contracts’s maturity date, which is denoted as T. In the financial interpretation, the process A is assumed to model the cumulative (promised) cash flows of a given contract, which are either paid out from the hedger’s wealth or added to his wealth via the value process of his portfolio of traded assets (including positive or negative holdings of cash, that is, lent or borrowed money). Note that the price of the contract \(\mathcal {C}\) exchanged at its initiation (that is, at time 0) is not included in A. For example, if the contract stipulates that the hedger will ‘receive’ the (possibly random and of arbitrary signs) cash flows \(a_{1},a_{2},\dots,a_{m}\) at times \(t_{1},t_{2},\dots,t_{m} \in (0,T]\), then A is given by

Let (At,0) denote a basic contract originated at time t with \(\mathcal {X} =0\). Then the only cash flow exchanged between the counterparties at time t is the price of the contract and thus the remaining cumulative cash flows of (At,0) are given as \(A^{t}_{u} := A_{u}-A_{t}\) for u∈[t,T]. In particular, the equality \(A^{t}_{t}=0\) is valid for any basic contract (A,0) and any date t∈[0,T). All future cash flows a l for l such that t l >t are predetermined, in the sense that they are explicitly specified by the contract covenants.

As a simple example of cash flows, consider the situation where the hedger sells at time t the European call option on the risky asset Si. Then m=1, t1=T, and the terminal payoff from the perspective of the hedger equals \(a_{1}=- \left (S^{i}_{T}-K\right)^{+}\). More generally, for every t∈[0,T), the process At is given by  for every u∈[t,T].

for every u∈[t,T].

To account for additional features of a particular contract at hand, we find it convenient to postulate that the cash flows A (resp. At) of a basic contract are complemented by trading adjustments, which are represented by the process \(\mathcal {X}\) (resp. \(\mathcal {X}^{t}\)) given as \(\mathcal {X}=\left (X^{1},\ldots, X^{n}; \alpha ^{1}, \ldots, \alpha ^{n}; \beta ^{1}, \ldots, \beta ^{n}\right).\) The role of \(\mathcal {X}\) is to describe additional clauses of a given contract, such as rehypothecated or segregated collateral, as well as to account for the impact of atypical trading arrangements on the value process of the hedger’s portfolio. For each adjustment process Xk, the process αkXk represents additional incoming or outgoing cash flows for the hedger, which are either stipulated in the clauses of the contract or imposed by a third party (for instance, the regulator). For each process Xk, k=1,2,…,n we also specify the remuneration process βk, which is used to determine the net interest payments (if any) associated with the process Xk. It should be noted that the processes \(X^{1}, \dots, X^{n}\) and the associated remuneration processes \(\beta ^{1}, \dots, \beta ^{n}\) do not represent traded assets. It is rather clear that the processes α and β may depend on the respective adjustment process. Therefore, when the adjustment process is \(\mathcal {Y}\), rather than \(\mathcal {X}\), one should write \(\alpha (\mathcal {Y})\) and \(\beta (\mathcal {Y})\) in order to avoid confusion. However, for brevity, we will keep the shorthand notation α and β when the adjustment process is denoted as \(\mathcal {X}\). For further comments on trading adjustment, we refer to Section 2.3 and 2.4. Last, but not least, we will need to define a suitable modification of the promised cash flows A resulting from the counterparty credit risk (see Definition 5 where the concept of counterparty risky cumulative cash flows is introduced).

In essence, by valuation of a given contract we mean the process of finding at any date t the range of the fair prices p t , as seen from the viewpoint of either the hedger or the counterparty. Although it will be postulated that the two parties in a contract adopt the same valuation paradigm, due to the asymmetry of cash flows, differential trading costs, and possibly also different trading opportunities, they will typically obtain different ranges for the respective fair unilateral prices for a given bilateral contract. Let us stress that the disparity in unilateral valuation done by the two parties is a consequence of the nonlinearity of the wealth dynamics in trading strategies, so that it will typically occur even within the framework of a complete nonlinear model where the perfect replication of any contract can be achieved by the counterparties. The important issue of determining the range of fair bilateral prices in a general nonlinear framework is left for a future research (for results on bilateral pricing in some specific nonlinear models, we refer to Nie and Rutkowski (2015, 2016a, 2018).

2.2 Self-financing trading strategies

The concept of a portfolio refers to the family of primary traded assets, that is, risky assets, cash accounts, and funding accounts for risky assets. Formally, by a portfolio on the time interval [t,T], we mean an arbitrary \({\mathbb R}^{3d+2}\)-valued, \(\mathbb {G}\)-adapted process \((\phi ^{t}_{u})_{u \in [t,T]}\) denoted as

where the components represent the positions in risky assets \(\left (S^{i},D^{i}\right),\, i=1,2, \dots, d\), cash accounts B0,l, B0,b, and funding accounts \(B^{i,l},B^{i,b},\, i=1,2, \dots, d\) for risky assets. It is postulated throughout that \(\psi ^{j,l}_{u} \geq 0,\, \psi ^{j,b}_{u} \leq 0\) and \(\psi ^{j,l}_{u} \psi ^{j,b}_{u} =0\) for all \(j=0,1, \dots,d\) and u∈[t,T]. If the borrowing and lending rates are equal, then we write ψj=ψj,l+ψj,b. It is also assumed throughout that the processes ξ1,…,ξd are \(\mathbb {G}\)-predictable.

We say that a portfolio ϕ is constrained if at least one of the components of the process ϕ is assumed to satisfy some explicitly stated constraints, which directly affect the choice of ϕ. For instance, we will need to impose conditions ensuring that the funding of each risky asset is done using the corresponding funding account. Another example of an explicit constraint is obtained when we set \(\psi ^{0,b}_{u} =0\) for all u∈[t,T], meaning that an outright borrowing of cash from the account B0,b is prohibited. For examples of markets with various kinds of portfolio constraints, we refer to Carassus et al. (2001), Fahim and Huang (2016), Karatzas and Kou (1996,1998), and Pulido (2014) and the references therein. The concept of a constrained portfolio should be contrasted with the notion of admissibility of a trading strategy that may involve some additional conditions imposed on the wealth process and thus indirectly also on the class of admissible processes ϕ (see Definition 8). Note that portfolio constraints are not a matter of choice, since they are due to genuine real-life restrictions imposed on traders. This should be contrasted with the idea of admissibility of a trading strategy, which is a mathematical artefact needed to preclude unrealistic arbitrage opportunities (like doubling strategies), which may be present within a stochastic model when continuous trading is allowed. Note in this regard that there is no need to be concerned with the admissibility under the realistic assumption that only a finite number of trading times is available to traders.

We are now in a position to state some standard technical assumptions underpinning our further developments.

Assumption 1

We work throughout under the following standing assumptions:

-

(i)

for every \(i=1,2,\dots, d\), the price Si of the ith risky asset is a semimartingale and the cumulative dividend stream Di is a process of finite variation with \(D^{i}_{0}=0\);

-

(ii)

the cash and funding accounts Bj,l and Bj,b are strictly positive and continuous processes of finite variation with \(B^{j,l}_{0}=B^{j,b}_{0}=1\) for j=0,1,…,d;

-

(iii)

the cumulative cash flow process A of any contract is a process of finite variation;

-

(iv)

the adjustment processes Xk, k=1,2,…,n and the auxiliary processes αk, k=1,2,…,n are semimartingales;

-

(v)

the remuneration processes βk, k=1,2,…,n are strictly positive and continuous processes of finite variation with \(\beta ^{k}_{0}=1\) for every k.

In the next definition, the \(\mathcal {G}_{t}\)-measurable random variable x

t

represents the endowment of the hedger at time t∈[0,T) whereas p

t

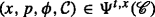

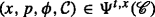

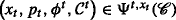

, which at this stage is an arbitrary \(\mathcal {G}_{t}\)-measurable random variable, stands for the price at time t of \(\mathcal {C}^{t}=\left (A^{t},\mathcal {X}^{t}\right)\), as seen by the hedger. Recall that At denotes the cumulative cash flows of the contract A that occur after time t, that is, \(A^{t}_{u}:=A_{u}-A_{t}\) for all u∈[t,T]. Hence At can be seen as a contract with the same remaining cash flows as the original contract A, except that At starts and is traded at time t. By the same token, we denote by \(\mathcal {X}^{t}\) the adjustment process related to the contract At. Let  be a predetermined class of contracts. As expected, it is assumed throughout that the null contract \(\mathcal {N}=(0,0)\) is traded in any market model at any time t, that is,

be a predetermined class of contracts. As expected, it is assumed throughout that the null contract \(\mathcal {N}=(0,0)\) is traded in any market model at any time t, that is,  for every t∈[0,T) (see Assumption 3).

for every t∈[0,T) (see Assumption 3).

It should be noted that the prices p

t

for contracts belonging to the class  are yet unspecified and thus there is a certain degree of freedom in the foregoing definitions. Note also that we use the convention that \(\int _{t}^{u}:=\int _{(t,u]}\) for any t≤u.

are yet unspecified and thus there is a certain degree of freedom in the foregoing definitions. Note also that we use the convention that \(\int _{t}^{u}:=\int _{(t,u]}\) for any t≤u.

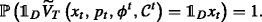

Definition 1

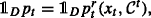

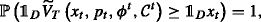

A quadruplet \(\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) is a self-financing trading strategy on [t,T] associated with the contract \(\mathcal {C}=(A,\mathcal {X})\) if the portfolio value\(V^{p} \left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\), which is given by

satisfies for all u∈[t,T]

where the adjusted gains process\(G\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) is given by

For a given pair (x t ,p t ), we denote by \(\Phi ^{t,x_{t}}\left (p_{t},\mathcal {C}^{t}\right)\) the set of all self-financing trading strategies on [t,T] associated with the contract \(\mathcal {C}\).

When studying valuation of the contract \(\mathcal {C}^{t}\) for a fixed t, we will typically assume that the hedger’s endowment x

t

is given and we will search for the range of hedger’s fair prices p

t

for \(\mathcal {C}^{t}\). Therefore, when dealing with the hedger with a fixed initial endowment x

t

at time t, we will consider the following set of self-financing trading strategies  Note, however, that the definition of the market model does not assume that the quantity x

t

is predetermined.

Note, however, that the definition of the market model does not assume that the quantity x

t

is predetermined.

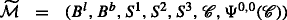

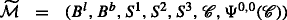

Definition 2

The market model is the quintuplet  where

where  stands for the set of all self-financing trading strategies associated with the class

stands for the set of all self-financing trading strategies associated with the class  of contracts, that is,

of contracts, that is,

In principle, the market model defined above exhibits nonlinear features, in the sense that either the portfolio value process \(V^{p}(x_{t},p_{t},\phi ^{t},\mathcal {C}^{t})\) is not linear in \((x_{t}, p_{t},\phi ^{t},\mathcal {C}^{t})\) or the class of all self-financing strategies is not a vector space (or, typically, both). Therefore, we refer to this setup as to a generic nonlinear market model. In contrast, by a linear market model we will understand in this paper the version of the model defined above in which all trading adjustments are null (i.e., Xk=0 for all \(k=1,2, \dots, n\)), there are no differential funding rates (i.e., Bj,b=Bj,l for all \(j=0,1, \dots, d\)) and no portfolio constraints are imposed. In particular, in the linear market model the class of all self-financing trading strategies is a vector space and the value process \(V^{p}\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) is a linear mapping in \(\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\). Note, however, that the last property is usually lost when an admissibility condition is imposed on the class of trading strategies since, typically, a trading strategy is deemed to be admissible if it its discounted wealth is bounded from below or nonnegative (hence the class of admissible trading strategies is no longer a vector space).

To alleviate notation, we will frequently write \((x,p,\phi,\mathcal {C})\) instead of \(\left (x_{0},p_{0},\phi ^{0},\mathcal {C}^{0}\right)\) when working on the interval [0,T]. Note that (2)–(4) yield the following equalities for any trading strategy

Recall that in the classical case of a frictionless market, it is common to assume that the initial endowments of traders are null. Moreover, the price of a derivative has no impact on the dynamics of the gains process. In contrast, when portfolio’s value is driven by nonlinear dynamics, the initial endowment x at time 0, the initial price p and the adjustment cash flows of a contract may all affect the dynamics of the gains process and thus the classical approach is no longer valid.

2.3 Funding adjustment

The concept of the funding adjustment refers to the spreads of funding rates with regard to some benchmark cash rate. In the present setup, it can be defined relative to either Bl or Bb. If the lending and borrowing rates are not equal, then (3) can be written as follows

where \(\widehat {B}^{j,l/b} := B^{j,l/b} \left (B^{0,l/b}\right)^{-1}\) and \(\widehat {\beta }^{k,l/b} := \beta ^{k}\left (B^{0,l/b}\right)^{-1} \). The quantity

is called the funding adjustment. If the borrowing and lending rates are equal, then the expression for the funding adjustment simplifies to

When the cash account B0 is used for funding and remuneration for adjustment processes, that is, when Bi=B0 for i=1,2,…,d and βk=B0 for k=1,2,…,n, then the funding adjustment vanishes, as was expected.

2.4 Financial interpretation of trading adjustments

In this study, we will devote significant attention to terms appearing in the dynamics of \(V^{p}(x,\varphi,A,\mathcal {X})\), which correspond to the trading adjustment process \(\mathcal {X}\).

Definition 3

The stochastic process \(\varpi =\sum _{k=1}^{n} \varpi ^{k} \), where for k=1,2,…,n,

is called the cash adjustment.

In general, the financial interpretation of the cash adjustment term ϖk is as follows: the term \(\alpha ^{k}_{t}X^{k}_{t}\) represents the part of the kth adjustment that the hedger can either use for his trading purposes when \(\alpha ^{k}_{t} X^{k}_{t} >0\) or has to put aside (for instance, pledge to his counterparty as a collateral or hold in a separate account as a regulatory capital) when \(\alpha ^{k}_{t} X^{k}_{t} <0\). Formally, the quantity \(-X_{t}^{k} \left (\beta ^{k}_{t}\right)^{-1}\) can be seen as the number of “shares” of the remuneration process βk that the hedger should hold at time t in order to cover interest payments associated with the adjustment process Xk. Hence the integral \(\int _{0}^{t} X_{u}^{k} \left (\beta ^{k}_{u}\right)^{-1}\, d\beta ^{k}_{u}\) represents the cumulative interest either paid or received by the hedger due to the presence of the kth trading adjustment.

Let us illustrate a few alternative interpretations of cash adjustments given by (6). We hereafter write \(\widehat {X}^{k}=\left (\beta ^{k}\right)^{-1} X^{k} \).

-

Let us first assume that \(\alpha ^{k}_{t}=1\), for all t. The term \(X^{k}_{t}-\int _{0}^{t} \widehat {X}^{k}_{u}\, d\beta ^{k}_{u}\) indicates that the cash adjustment ϖk is affected by both the current value \(X^{k}_{t}\) of the adjustment process and by the cost of funding of this adjustment given by the integral \(\int _{0}^{t} \widehat {X}^{k}_{u}\, d\beta ^{k}_{u}\). Such a situation occurs, for example, when Xk represents the capital charge or the rehypotecated collateral. The integration by parts formula gives

$$ \varpi^{k}_{t} = X^{k}_{t}-\int_{0}^{t} \widehat{X}^{k}_{u}\, d\beta^{k}_{u}=X^{k}_{0}+\int_{0}^{t}\, \beta^{k}_{u}\, d\widehat{X}^{k}_{u}, $$(7)where the integral \(\int _{0}^{t} \beta ^{k}_{u}\,d\widehat {X}^{k}_{u}\) has the following financial interpretation: \(\widehat {X}^{k}_{u}\) is the number of units of the funding account \(\beta ^{k}_{u}\) that are needed to fund the amount \(X^{k}_{u}\) of the adjustment process. Hence \(d\widehat {X}^{k}_{u}\) is the infinitesimal change of this number and \(\beta ^{k}_{u}\,d\widehat {X}^{k}_{u}\) is the cost of this change, which has to be absorbed by the change in the value of the trading strategy. Observe that the term \(\beta ^{k}_{u}\,d\widehat {X}^{k}_{u}\) may be negative, meaning that a cash relieve situation is taking place.

-

In the special case when \(\alpha ^{k}_{t}=1\) and \(\beta ^{k}_{t}=1\) for all t, we obtain \(\varpi ^{k}_{t}=X^{k}_{t}\) for all t. We deal here with the cash adjustment Xk on which there is no remuneration since manifestly \(\int _{0}^{t} \widehat {X}^{k}_{u}\,d\beta ^{k}_{u}=0.\) This situation may arise, for example, if the bank does not use any external funding for financing this adjustment, but relies on its own cash reserves, which are assumed to be kept idle and neither yield interest nor require interest payouts.

-

Let us now assume that \(\alpha ^{k}_{t}=0\) for all t. Then the term \( \varpi ^{k}_{t}=- \int _{0}^{t} \widehat {X}^{k}_{u}\, d\beta ^{k}_{u}\) indicates that the cash value of the adjustment Xk does not contribute to the portfolio value. Only the remuneration of the adjustment process Xk, which is given by the integral \(\int _{0}^{t} \widehat {X}^{k}_{u}\, d\beta ^{k}_{u}\), contributes to the portfolio’s value. This happens, for example, when the adjustment process represents the collateral posted by the counterparty and kept in the segregated account.

The above considerations lead to the following lemma, which gives a convenient representation for the cash adjustment process when αk is equal to either 1 or 0. In most practical situations, a general case can also be dealt with using Lemma 1 and a suitable redefinition of adjustment processes.

Lemma 1

Let the non-negative integers n1,n2,n3 be such that n1+n2+n3=n. If αk=1 for \(k=1,2,\dots, n_{1}+n_{2}\), βk=1 for \(k=n_{1}, n_{1}+1, \dots, n_{1}+n_{2}\) and αk=0 for \(k=n_{1}+n_{2}, n_{1}+n_{2}+1, \dots, n_{1}+n_{2}+n_{3}\), then the cash adjustment process ϖ satisfies, for all t∈[0,T],

2.5 Wealth process

Let \((x, p,\phi,\mathcal {C})\) be an arbitrary self-financing trading strategy. Then the following natural question arises: what is the wealth of a hedger at time t, say \(V_{t}(x, p,\phi,\mathcal {C})\)? It is clear that if the hedger’s initial endowment equals x, then his initial wealth equals x+p when he sells a contract \(\mathcal {C} \) at the price p at time 0. By contrast, the initial value of the hedger’s portfolio, that is, the total amount of cash he invests at time 0 in his portfolio of traded assets, is given by (5) meaning that the trading adjustments at time 0 need to be accounted for in the initial portfolio’s value. However, according to the financial interpretation of trading adjustments, they have no bearing on the hedger’s initial wealth and thus the relationship between the hedger’s initial wealth and the initial portfolio’s value reads

Analogous arguments can be used at any time t∈[0,T], since the hedger’s wealth at time t should represent the value of his portfolio of traded assets net of the value of all trading adjustments (see (10)). Furthermore, one needs to focus on the actual ownership (as opposed to the legal ownership) of each of the adjustment processes \(X^{1}, \dots, X^{n}\), of course, provided that they do not vanish at time t. Although this general rule is cumbersome to formalize, it will not present any difficulties when applied to a particular contract at hand.

For instance, in the case of the rehypothecated cash collateral (see Section 2.7.1), the hedger’s wealth at time t should be computed by subtracting the collateral amount C t from the portfolio’s value. This is consistent with the actual ownership of the cash amount delivered by either the hedger or the counterparty at time t. For example, if \(C^{+}_{t}>0\) then the legal owner of the amount \(C^{+}_{t}\) at time t could be either the hedger or the counterparty (depending on the legal covenants of the collateral agreement) but the hedger, as a collateral taker, is allowed to use the collateral amount for his trading purposes. If there is no default before T, the collateral taker returns the collateral amount to the collateral provider. Hence the amount \(C^{+}_{t}\) should be accounted for when dealing with the hedger’s portfolio, but should be excluded from his wealth. In general, we have the following definition of the wealth process.

Definition 4

The wealth process of a self-financing trading strategy \((x_{t}, p_{t},\phi ^{t},\mathcal {C}^{t})\) is defined, for every u∈[t,T], by

or, more explicitly,

Let us observe that there is a lot of flexibility in the choice of the adjustment processes Xk and corresponding processes αk. However, we will always assume that these processes are specified such that the above arguments of interpreting the actual ownership of the capital and thus also of the wealth process \(V(x,p,\phi, A,\mathcal {X})\) hold true.

As an immediate consequence of Definitions 1 and 4, it follows that the wealth process V of any self-financing trading strategy \((x_{t}, p_{t},\phi ^{t},\mathcal {C}^{t})\) admits the dynamics, for u∈[t,T],

One could argue that it would be possible to take Eqs. (10) and (11) as the definition of a self-financing trading strategy and subsequently deduce that equality (3) holds for the portfolio’s value \(V^{p}(x,p,\phi,\mathcal {C})\), which is then given by (9). We contend this alternative approach would not be optimal, since conditions in Definition 1 are obtained through a straightforward analysis of the trading mechanism and physical cash flows, whereas the financial justification of Eqs. (10)–(11) is less appealing.

Clearly, the wealth processes of a self-financing trading strategy is characterized in terms of two Eqs. 10 and (11). Observe that, using (10), it is possible to eliminate one of the processes ψj,l or ψj,b from (11) and thus to characterize the wealth process in terms of a single equation. One obtains in that way a (typically nonlinear) BSDE, which can be used to formulate various valuation problems for a given contract.

2.6 Trading in risky assets

Note that we do not postulate that the processes \(S^{i},\, i=1,2, \dots, d\) are positive, unless it is explicitly stated that the process Si models the price of a stock. Hence by the long cash position (resp. short cash position), we mean the situation when \(\xi ^{i}_{t} S^{i}_{t} \leq 0 \left (\text {resp}.\ \xi ^{i}_{t} S^{i}_{t} \geq 0\right)\), where \(\xi ^{i}_{t}\) is the number of hedger’s positions in the risky asset Si at time t.

2.6.1 Cash market trading

For simplicity of presentation, we assume that \(S^{i}_{t} \geq 0\) for all t∈[0,T]. Assume first that the purchase of \(\xi ^{i}_{t} > 0\) shares of the ith risky asset is funded using cash. Then, we set \(\psi ^{i,b}_{t}=0\) for all t∈[0,T] and thus the process Bi,b becomes irrelevant. Let us now consider the case when \(\xi ^{i}_{t} <0\). If we assume that the proceeds from short selling of the risky asset Si can be used by the hedger (this is typically not true in practice), we also set \(\psi ^{i,l}_{t}=0\) for all t∈[0,T], and thus the process Bi,l becomes irrelevant as well. Hence, under these stylized cash trading conventions, there is no need to introduce the funding accounts Bi,l and Bi,b for the ith risky asset. Since dividends Di are passed over to the lender of the asset, they do not appear in the term representing the gains/losses from the short position in the risky asset. In the simplest case of no market frictions and trading adjustments, and with the single risky asset S1, under the present short selling convention, (3) becomes

More practical short selling conventions for risky assets are discussed in the foregoing subsections.

2.6.2 Short selling of risky assets

Let us now consider the classical way of short selling of a risky asset borrowed from a broker. In that case, the hedger does not receive the proceeds from the sale of the borrowed shares of a risky asset, which are held instead by the broker as the cash collateral. The hedger may also be requested to post additional cash collateral to the broker and, in some cases, he may be paid interest on his margin account with the broker.Footnote 1 To represent these trading arrangements for the ith risky asset, we set \(\psi ^{i,l}_{t}=0\), \(\alpha ^{i}_{t}=\alpha _{t}^{i+d}=0\) and

where \(\beta ^{i}_{t}\) specifies the interest (if any) on the hedger’s margin account with the broker, \(\delta ^{i}_{t} \geq 0\) represents an additional cash collateral, and βi+d specifies the interest rate paid by the hedger for financing the additional collateral. Let us assume, for instance, that there is only one risky asset, S1, which is either sold short or purchased using cash as in Section 2.6.1. Then we obtain the following expression for the portfolio value

whereas Eq. 3 becomes

In particular, if there is no specific interest rate for remuneration of an additional collateral, then we set X2=0 and thus the last term in (13) should be omitted. It is worth noting that (12) can be seen as a special case of the following extended version of (2)

with d=1 and h1(x)=x+ for \(x \in \mathbb {R}\).

2.6.3 Repo market trading

Let us first consider the cash-driven repo transaction, the situation when shares of the ith risky asset owned by the hedger are used as collateral to raise cash.Footnote 2 To represent this transaction, we set

where Bi,b specifies the interest paid to the lender by the hedger who borrows cash and pledges the risky asset Si as collateral, and the constant hi,b represents the haircut for the ith asset pledged.

A synthetic short-selling of the risky asset Si using the repo market is obtained through the security-driven repo transaction, that is, when shares of the risky asset are posted as collateral by the borrower of cash and they are immediately sold by the hedger who lends the cash. Formally, this situation corresponds to the equality

where Bi,l specifies the interest amount paid to the hedger by the borrower of the cash amount \(\left (1-h^{i,l}\right)\left (\xi ^{i}_{t}\right)^{-} S^{i}_{t}\) and hi,l is the corresponding haircut.

If only one risky asset is traded and transactions are exclusively in repo market, then we obtain

In practice, it is reasonable to assume that the long and short repo rates for a given risky asset are identical, that is, Bi=Bi,l=Bi,b. In that case, we may and do set \(\psi ^{i}_{t} =(1-h^{i})\left (B^{i}_{t}\right)^{-1} \xi ^{i}_{t} S^{i}_{t} \), so that Eqs. 14 and (15) reduce to just one equation

According to this interpretation of Bi, equality (17) means that trading in the ith risky asset is done using the (symmetric) repo market and \(\xi ^{i}_{t}\) shares of a risky asset are pledged as collateral at time t, meaning that the collateralization rate equals 1. Under (17), Eq. 16 reduces to

2.7 Collateralization

We consider the situation when the hedger and the counterparty enter a contract and either receive or pledge collateral with value denoted by C, which is assumed to be a semimartingale. Generally speaking, the process C represents the value of the margin account. We let

where  and

and  By convention, the amount \(C^{+}_{t}\) is the cash value of collateral received at time t by the hedger from the counterparty, whereas \(C^{-}_{t}\) represents the cash value of the collateral pledged by him and thus transferred to his counterparty. For simplicity of presentation and consistently with the prevailing market practice, it is postulated throughout that only cash collateral may be delivered or received (for other collateral conventions, see, e.g., Bielecki and Rutkowski (2015)). According to ISDA Margin Survey 2014, about 75% of non-cleared OTC collateral agreements are settled in cash and about 15% in government securities. We also make the following natural assumption regarding the value of the margin account at the contract’s maturity date.

By convention, the amount \(C^{+}_{t}\) is the cash value of collateral received at time t by the hedger from the counterparty, whereas \(C^{-}_{t}\) represents the cash value of the collateral pledged by him and thus transferred to his counterparty. For simplicity of presentation and consistently with the prevailing market practice, it is postulated throughout that only cash collateral may be delivered or received (for other collateral conventions, see, e.g., Bielecki and Rutkowski (2015)). According to ISDA Margin Survey 2014, about 75% of non-cleared OTC collateral agreements are settled in cash and about 15% in government securities. We also make the following natural assumption regarding the value of the margin account at the contract’s maturity date.

Assumption 2

The \(\mathbb {G}\)-adapted collateral amount process C satisfies C T =0.

Typically this means that the collateral process C will have a jump at time T from CT− to 0. The postulated equality C T =0 is simply a convenient way of ensuring that any collateral amount posted is returned in full to the pledger when the contract matures, provided that default events have not occurred prior to or at maturity date T. As soon as the default events are also modeled, we will need to specify closeout payoffs (see Section 2.8.1).

Let us first make some comments from the hedger’s perspective regarding the crucial features of the margin account. The financial practice may require to hold the collateral amounts in segregated margin accounts, so that the hedger, when he is a collateral taker, cannot make use of the collateral amount for trading. Another collateral convention mostly encountered in practice is rehypothecation (around 90% of cash collateral of OTC contracts are rehypothecated), which refers to the situation where the hedger may use the collateral pledged by his counterparties as collateral for his contracts with other counterparties. Obviously, if the hedger is a collateral provider, then a particular convention regarding segregation or rehypothecation is immaterial for the dynamics of the value process of his portfolio. We refer the reader to Bielecki and Rutkowski (2015) and Crépey et al. (2014) for a detailed analysis of various conventions on collateral agreements. Here we will examine some basic aspects of collateralization (sometimes also called margining) in our context.

In general, the cash adjustments due to collateralization are

where the remuneration processes β1 and β2 determine the interest rates paid or received by the hedger on collateral amounts C+ and C−, respectively. The auxiliary processes α1 and α2 introduced in (20) are used to cover alternative conventions regarding rehypothecation and segregation of margin accounts. Note that we always set \(\alpha ^{2}_{t}=1\) for all t∈[0,T] when considering the portfolio of the hedger, since a particular convention regarding rehypothecation or segregation is manifestly irrelevant for the pledger of collateral.

2.7.1 Rehypothecated collateral

As it is customary in the existing literature, we assume that rehypothecation of cash collateral means that it can be used by the hedger for his trading purposes without any restrictions. To cover this stylized version of a rehypothecated collateral for the hedger, it suffices to set \(\alpha ^{1}_{t}=\alpha ^{2}_{t} =1\) for all t∈[0,T], so that for the hedger we obtain \(\alpha _{t}^{1}X^{1}_{t}+\alpha _{t}^{2}X^{2}_{t}=C_{t}\). Consequently, the cash adjustment corresponding to the margin account equals

2.7.2 Segregated collateral

Under segregation, the collateral received by the hedger is kept by the third party, so that it cannot be used by the hedger for his trading activities. In that case, we set \(\alpha ^{1}_{t}=0\) and \(\alpha ^{2}_{t} =1\) for all t∈[0,T] and thus \(\alpha _{t}^{1}X^{1}_{t}+\alpha _{t}^{2}X^{2}_{t}=-C^{-}_{t}\). Hence the corresponding cash adjustment term ϖ equals

2.7.3 Initial and variation margins

In market practice, the total collateral amount is usually represented by two components, which are termed the initial margin (also known as the independent amount) and the variation margin. In the context of self-financing trading strategies, this can be easily dealt with by introducing two (or more) collateral processes for a given contract A. It is worth mentioning that each of the collateral processes specified in the clauses of a contract is usually subject to a different convention regarding segregation and/or remuneration.

2.8 Counterparty credit risk

The counterparty credit risk in a financial contract arises from the possibility that at least one of the parties in the contract may default prior to or at the contract’s maturity, which may result in failure of this party to fulfil all their contractual obligations leading to financial loss suffered by either one of the two parties in the contract. We will model defaultability of the two parties to the contract in terms of their default times. We denote by τh and τc the default times of the hedger and his counterparty, respectively. We require that τh and τc are non-negative random variables defined on \((\Omega, \mathcal {G}, \mathbb {G}, \mathbb {P})\). If τh>T holds a.s. (resp. τc>T, a.s.) then the hedger (resp. the counterparty) is considered to be default-free in regard to the contract under study. Hence the counterparty risk is a relevant aspect for the contract maturing at T provided that \(\mathbb {P}(\tau \leq T)>0\) where τ:=τh∧τc is the moment of the first default.

From now on, we postulate that the process A models all promised (or nominal) cash flows of the contract, as seen from the perspective of the trading desk without accounting for the possibility of defaults of trading parties. In other words, A represents cash flows that would be realized in case none of the two parties has defaulted prior to or at the contract’s maturity. We will sometimes refer to A as to the counterparty risk-free cash flows and we will call the contract with cash flows A the counterparty risk-free contract. The key concept in the context of counterparty risk is the counterparty risky contract, which will be examined in the foregoing subsection.

2.8.1 Closeout payoff

Recall that τ denotes the moment of the first default. On the event \(\{ \tau <\infty \}\), we define the random variable Υ as

where Q is the Credit Support Annex (CSA) closeout valuation process of the contract A, ΔA τ =A τ −Aτ− is the jump of A at τ corresponding to a (possibly null) promised bullet dividend at τ, and C τ is the value of the collateral process C at time τ. In the financial interpretation, Υ+ is the amount the counterparty owes to the hedger at time τ, whereas Υ− is the amount the hedger owes to the counterparty at time τ. It accounts for the legal value Q τ of the contract, plus the bullet dividend ΔA τ to be received/paid at time τ, less the collateral amount C τ since it is already held by either the hedger (if C τ >0) or the counterparty (if C τ <0). We refer the reader to Section 3.1.3 in Crépey et al. (2014) for the detailed discussion of the specification of Υ.

One of the key financial aspects of the counterparty credit risk is the closeout payoff, which occurs if at least one of the parties defaults either before or at the maturity of the contract. It represents the cash flow exchanged between the two parties at the first-party-default time. The following definition of the closeout payoff, as usual given from the perspective of the hedger, is taken from Crépey et al. (2014). The random variables R c and R h taking values in [0,1] represent the recovery rates of the counterparty and the hedger, respectively.

Definition 5

The CSA closeout payoff\(\mathfrak {K}\) is defined as

The counterparty risky cumulative cash flows process A♯ is given by

Let us make some comments on the form of the closeout payoff \(\mathfrak {K}\). First, the term C τ is due to the fact that the legal title to the collateral amount comes into force only at the time of the first default. The three terms appearing after C τ in (24) correspond to the CSA convention that the cash flow at the first default from the perspective of the hedger should be equal to Q τ +ΔA τ . Let us consider, for instance, the event {τ c <τ h }. If Υ+>0, then we obtain

where the equality holds whenever R c =1. If Υ−>0, then we get

Finally, if Υ=0, then \(\mathfrak {K}=C_{\tau }=Q_{\tau }+ \Delta A_{\tau } \). Similar analysis can be done on the remaining two events in (24).

Remark 1

Of course, there is no counterparty credit risk present under the assumption that \(\mathbb {P}(\tau >T)=1\). Let us consider the case where \(\mathbb {P}(\tau >T) < 1\). We denote by \(P^{e}_{t}\) the counterparty risk-free ex-dividend price of the contract at time t. If we set R c =R h =1, then we obtain

Hence the counterparty credit risk is still present, despite the postulate of the full recovery, unless the legal value Q τ perfectly matches the counterparty risk-free ex-dividend price \(P^{e}_{\tau }\). Obviously, the counterparty credit risk vanishes when R c =R h =1 and \(Q_{\tau }= P^{e}_{\tau } \), since in that case the so-called exposure at default (see Section 3.2.3 in Crépey et al. (2014)) is null.

2.8.2 Counterparty credit risk decomposition

To effectively deal with the closeout payoff in our general framework, we now define the counterparty credit risk (CCR) cash flows, which are sometimes called CCR exposures. Note that the events \(\left \{ \tau =\tau ^{h} \right \}=\left \{ \tau ^{h} \leq \tau ^{c} \right \}\) and \(\left \{ \tau =\tau ^{c} \right \}=\left \{ \tau ^{c} \leq \tau ^{h} \right \}\) may overlap.

Definition 6

By the CCR processes, we mean the processes CL,CG and RP where the credit lossCL equals

the credit gain CG equals

and the replacement process is given by

The CCR cash flow is given by ACCR=CL+CG+CR.

It is worth noting that the CCR cash flows depend on the processes A,C and Q. The next proposition shows that we may interpret the counterparty risky contract as the basic contract A, which is complemented by the collateral adjustment process \(\mathcal {X}=\left (X^{1},X^{2}\right)= (C^{+},-C^{-})\) and the CCR cash flow ACCR. In view of this result, the counterparty risky contract \((A^{\sharp },\mathcal {X})\) admits the following formal decompositions \((A^{\sharp },\mathcal {X}) = (A,\mathcal {X})+(A^{\text {CCR}},0)\) and \((A^{\sharp },\mathcal {X})=(A,0)+(A^{\text {CCR}},\mathcal {X})\).

Proposition 1

The equality \(A^{\sharp }_{t}=A_{t}+A^{\text {CCR}}_{t}\) holds for all t∈[0,T].

Proof

We first note that

where we used (23) in the last equality. Therefore, from (25) we obtain

which is the desired equality in view of Definition 6. □

Proposition 1 shows that cash flows of the counterparty risky contract can be formally decomposed into the counterparty risk-free component \((A^{1},\mathcal {X}^{1})=(A,\mathcal {X})\) and the CCR component \((A^{2},\mathcal {X}^{2})=\left (A^{\text {CCR}},0\right)\). This additive decomposition of the contract’s cash flows may be employed in pricing of a counterparty risky contract. For instance, one could attempt to compute the price of the contract \((A^{\sharp },\mathcal {X})\) using the following tentative decomposition

It is unlikely that this procedure would result in an overall arbitrage-free valuation of the counterparty risky contract in a nonlinear framework since, as we argue in Section 6, the additivity of ex-dividend prices obtained by solving nonlinear BSDEs fails to hold, in general.

2.9 Local and global valuation problems

Market adjustments, which are represented in our framework by the process \(\mathcal {X}\), may in fact depend both on the cash flow process A and the trading strategy φ. By the same token, the trading strategy φ will typically depend on the trading adjustments. So, a feedback effect between φ and \(\mathcal {X}\) is potentially present in our trading universe and, of course, this feature should be properly accounted for in valuation and hedging. Furthermore, it is important to distinguish between the case where the above-mentioned dependence is only on the current composition of the hedging strategy and the current level of the wealth process and where the dependence extends to the history of these processes. If the contract \((A,\mathcal {X})\), the cash and funding accounts, and the prices of risky assets do not depend on the strict history (i.e., the history not including the current values of processes of interest) of a hedger’s trading strategy ϕ and its wealth process V(ϕ), then we say that the valuation problem is local. Otherwise, it is referred to as a global valuation problem. In view of (11), the distinction between local and global problems can be formalized through the following definition.

Definition 7

The valuation problem is local if \(X^{k}_{t}=v^{k}(t, V_{t}(\phi),\phi _{t})\) and \(d\beta _{t}^{k}=w^{k}(t,V_{t}(\phi),\phi _{t})\,dt\) for some \(\mathbb {G}\)-progressively measurable mappings \(v^{k},w^{k}:\Omega \times [0,T] \times \mathbb {R}^{3(d+1)} \to \mathbb {R} \) for every \(k=1,2,\dots,n\). The valuation problem is global if \(X^{k}_{t}=\bar {v}^{k}(t,V_{\cdot }(\phi),\phi _{\cdot })\) and \(d\beta _{t}^{k}= \bar {w}^{k}(t,V_{\cdot } (\phi),\phi _{\cdot })\,dt\) for some \(\mathbb {G}\)-non-anticipative functionals \(\bar {v}^{k},\bar {w}^{k} : \Omega \times [0,T] \times \mathcal {D} \left ([0,T], \mathbb {R}^{3(d+1)}\right) \to \mathbb {R} \) for every \(k=1,2,\dots,n\) where \( \mathcal {D} \left ([0,T], \mathbb {R}^{3(d+1)}\right)\) is the space of \(\mathbb {R}^{3(d+1)}\)-valued, \(\mathbb {G}\)-adapted, càdlàg processes on [0,T].

As one might guess, solutions to the two valuation problems will always coincide at time 0 but, in general, they may have very different properties at any date t∈(0,T). In particular, they will typically correspond to different classes of BSDEs: local problems correspond to classical BSDEs, whereas global ones can be dealt with through generalized BSDEs, which were introduced in the recent work by Cheridito and Nam (2017) (see also Zheng and Zong (2017)). It is important to stress that the distinction between the local and global problems is not related to the concept of path-independent contingent claims or the Markov property of the underlying model for primary risky assets. It is only due to the above-mentioned (either local or global) feedback effect between the hedger’s trading decisions and the market conditions inclusive of particular adjustments for the contract at hand.

Example 1 As a stylized example of a global valuation problem, let us consider a contract, which lasts for two months (for concreteness, assume that it is a simple combination of the put and the call on the stock S1 with maturities equal to one month and two months, respectively). The borrowing rate for the hedger is set to be 5% per annum, rising to 6% after one month if the hedger borrows any cash during the first month and it will stay at 5% if he does not. Similarly, the lending rate initially equals 3% per annum and drops to 2% if the hedger borrows any cash during the first month. It is intuitively clear that the valuation problem here is global, since its solution on [t,T] will depend on the strict history of trading. In contrast, if the trading model has possibly different, but fixed, borrowing and lending rates, then the valuation problem for any contract will be local, in the sense introduced above, of course, unless some other trading adjustments will depend on the strict history of trading.

For instance, if the only adjustment is the variable margin account determined by the hedger’s valuation and with a constant remuneration rate, then the hedger’s valuation problem is local. Note that the valuation problem described above can be inherently global even when the stock price is governed under the real-world probability measure by Markovian dynamics and the contract under study is a standard call or put option (or any other path-independent contingent claim).

More general instances of local and global valuation problems are presented in Section 6 where we examine a BSDE approach to the nonlinear markets. Let us mention that most valuation problems examined in the existing literature are local and thus they can be solved using existing results for classical BSDEs. In contrast, global valuation problems are much harder to analyze, since they require to use novel classes of BSDEs (see Cheridito and Nam (2017), Zheng and Zong (2017) and the references therein).

3 No-arbitrage properties of nonlinear markets

The analysis of the self-financing property of a trading strategy should be complemented by the study of some kind of no-arbitrage property for the adopted market model. Due to the nonlinearity of a market model with differential funding rates, the question how to properly define the no-arbitrage property is already a nontrivial matter, even when no additional portfolio constraints or trading adjustments are taken into account. Nevertheless, we will argue that it can be effectively dealt with using some reasonably general definition of an arbitrage opportunity associated with trading. Let us stress that we only examine here a nonlinear extension of the classical concept of an arbitrage opportunity and hence the simplest definition of no-arbitrage, sometimes abbreviated as NA (see, for instance, part (iv) in Definition 2.2 in Fontana (2015)), as opposed to much more sophisticated concepts, such as: NFLVR (no free lunch with vanishing risk), NUPBR (no unbounded profit with bounded risk, which is also known as the no-arbitrage of the first kind, that is, NA1) or NIP (no increasing profit). The introduction of more sophisticated no-arbitrage conditions is motivated by the desire to establish a suitable version of the fundamental theorem of asset pricing (FTAP), which shows the equivalence between a particular form of no-arbitrage and the existence of some kind of a “martingale measure” for the discounted prices of primary assets. Due to the complexity of a general nonlinear market model, it is unlikely that the martingale technique underpinning the FTAP in the linear setup will also prove useful when working within the general nonlinear framework (see, however, Pulido (2014) who established the FTAP for a very special, and hence tractable, case of a nonlinear market with short sales prohibitions). In this paper, we only propose alternative definitions of no-arbitrage in a nonlinear framework and we give sufficient conditions for the no-arbitrage property of a general nonlinear market model.

3.1 No-arbitrage pricing principles

Let us first describe very succinctly the classical valuation paradigm for financial derivatives. In essence, a general approach to the arbitrage-free pricing hinges, at least implicitly, on the following arguments:

Step (L.1). One first checks whether a market model with predetermined trading rules and primary traded assets is arbitrage-free, where the definition of an arbitrage opportunity is a mathematical formalization of the real-world concept of a risk-free profitable trading opportunity. In fact, depending on the framework at hand, several alternative definitions of “no-arbitrage” were studied (for an overview, see Fontana (2015)).

Step (L.2). Given a financial derivative for which the price is yet unspecified, one proposes a price (not necessarily unique) and checks whether the extended model (that is, the model where the financial derivative is postulated to be an additional traded asset) preserves the no-arbitrage property in the sense made precise in Step (L.1).

The valuation procedure outlined above can be referred to as the arbitrage-free pricing paradigm. In any linear market model (see the comments after Definition 2), one can show that the unique price given by replication (or the range of no-arbitrage prices obtained using the concept of superhedging strategies in the case of an incomplete market) is consistent with the arbitrage-free pricing paradigm (L.1)–(L.2), although to establish this property in a continuous-time framework, one needs also to introduce the concept of admissibility of a trading strategy. In particular, the strict comparison property of linear BSDEs can be employed to show that replication (or superhedging) will indeed yield prices for derivatives that are consistent with the arbitrage-free pricing paradigm.

Alternatively, a suitable version of the fundamental theorem of asset pricing can be used to show that the discounted prices defined through admissible trading strategies are σ-martingales (hence, in fact, supermartingales) under an equivalent local martingale measure. The latter property is a well known fundamental feature of stochastic integration, so it covers all linear market models. Obviously, our very brief summary of linear arbitrage-free pricing theory is rather superficial and we acknowledge that it should be complemented by suitable assumptions on prices of traded assets and specific definitions of no-arbitrage. For a survey of classical results regarding no-arbitrage properties of linear market models, we refer to the monograph by Delbaen and Schachermayer (2006) (see also papers by Karatzas and Kardaras (2007), Kardaras (2012), and Takaoka and Schweizer (2014) for more recent developments).

Let us now comment on the existing approaches to the nonlinear valuation of derivatives, as first developed by El Karoui and Quenez (1997) and El Karoui et al. (1997) and later applied by several authors to particular financial models or classes on contracts (see, for instance, Bichuch et al. (2018), Brigo and Pallavicini (2014), Crépey (2015a, b), Dumitrescu et al. (2017), Mercurio (2013) or Pallavicini et al. (2012a, b)). The most common approach to the valuation problem in a nonlinear framework seems to hinge, at least implicitly, on the following steps in which it is usually assumed that the hedger’s initial endowment is immaterial and thus it may be set to zero. In fact, Step (N.1) was explicitly addressed only in some of the above-mentioned works, whereas in most papers in the existing literature the authors were only concerned with the issue of finding a replicating or a superhedging strategy, as briefly outlined in Step (N.2). Also, to the best of our knowledge, the important issue emphasized in Step (N.3) has been completely ignored up to now, since apparently it was implicitly taken for granted that the cost of replication, as given by a solution to a suitable BSDE, is a fair price of the contract.

Step (N.1). The strict comparison argument for the BSDE associated with the wealth dynamics is used to show that one cannot construct an admissible trading strategy with the null initial wealth and the terminal wealth, which is non-negative almost surely and strictly positive with a positive probability (hence the classical no-arbitrage property holds).

Step (N.2). The price for a European contingent claim is defined using either the cost of replication or the minimal cost of superhedging. A suitable version of the strict comparison property for wealth processes can be used to show that, for some nonlinear market models, the two pricing approaches yield the same value for any replicable European claim.

Step (N.3). It remains to check if the tentative price, as given by the cost of replication or selected to be below the upper bound given by the minimal cost of superhedging, complies with some form of the no-arbitrage property of the extended market.

We will argue that the question whether the extended nonlinear market model preserves the no-arbitrage property (of course, according to each particular definition of no-arbitrage) is much harder to resolve than it was in the linear framework. Intuitively, this is due to the fact that trading in derivatives may essentially change the properties of the original nonlinear market, whereas some version of the FTAP can be used to give a positive answer to the same question in the linear setup. We propose a partial solution in the nonlinear framework by putting forward in Section 4.2 the concept of the regular market model (see Definitions 19 and 21) and we establish some results on the fair pricing in a regular model (see Propositions 3 and 5).

3.2 Discounted wealth and admissible strategies

To deal with the issue of no-arbitrage, we need to introduce the discounted wealth process and properly define the concept of admissibility of trading strategies. For any \(x \in \mathbb {R}\), we denote by \(\mathcal {B} (x)\) the strictly positive process given by, for all t∈[0,T],

Note that if B0,l=B0,b, then \({\mathcal {B}} (x)=B^{0}=B\). Furthermore, if x=0, then \(xB^{0,b}_{t}= xB^{0,l}_{t}=0\) for all t∈[0,T] and thus the choice of either B0,l or B0,b in the right-hand side of (26) will be in fact immaterial. It is natural to postulate that the initial endowment x≥0 (resp. x<0) has the future value \(x B^{0,l}_{t} \left (\text {resp}.\ xB^{0,b}_{t}\right)\) at time t∈[0,T] when invested in the cash account \(B^{0,l} \left (\text {resp}.\ B^{0,b}\right)\). We henceforth work under the following assumption.

Assumption 3

We postulate that:

-

(i)

for any initial endowment \(x \in \mathbb {R}\) of the hedger, the null contract\(\mathcal {N}=(0,0)\) belongs to

,

, -

(ii)

for any \(x \in \mathbb {R}\), the trading strategy \(\left (x,0,\widehat {\phi },\mathcal {N} \right)\), where all components of \(\widehat {\phi }\) vanish except for either ψ0,l, if x≥0, or ψ0,b, if x<0, belongs to

and \(V^{p}_{t} (x,0,\widehat {\phi }, \mathcal {N})=V_{t} (x,0,\widehat {\phi }, \mathcal {N})=x \mathcal {B}_{t}(x) \) for all t∈[0,T].

and \(V^{p}_{t} (x,0,\widehat {\phi }, \mathcal {N})=V_{t} (x,0,\widehat {\phi }, \mathcal {N})=x \mathcal {B}_{t}(x) \) for all t∈[0,T].

At the first glance, Assumption 3 may look trivial or even redundant but it should be made and it will be useful in the derivation of fundamental properties of fair prices. Condition (i) is indeed a rather obvious formal requirement. Note, however, that condition (ii) cannot be deduced directly from the self-financing condition, since it hinges on the additional postulate that there are no trading adjustments (such as: taxes, transactions costs, margin account, etc.) when the initial endowment is invested in the cash account. It is needed to show that the null contract has fair price zero at any date t∈[0,T]. Also, the trading strategy introduced in condition (ii) will serve as a natural benchmark for assessment of profits or losses incurred by the hedger. A natural extension of Assumption 3 to the case where we study trading strategies on [t,T] is also implicitly postulated without stating it explicitly.

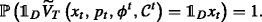

In the next necessary step, we follow the standard approach of introducing the concept of admissibility for the discounted wealth. Towards this end, for any fixed t∈[0,T), we consider a hedger who starts trading at time t with the initial endowment x t and uses a self-financing trading strategy \((x_{t},p_{t},\phi ^{t},\mathcal {C}^{t})\), where the price \(p_{t} \in \mathcal {G}_{t}\) at which the contract \(\mathcal {C}^{t}\) is traded at time t is arbitrary. We also consider the strictly positive discounting process \(\mathcal {B}^{t} (x_{t})\), which is defined for all u∈[t,T] by

so that, in particular,  Then the wealth process discounted back to time t satisfies, for all u∈[t,T],

Then the wealth process discounted back to time t satisfies, for all u∈[t,T],

and we have the following natural concept of admissibility of a trading strategy on [t,T].

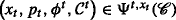

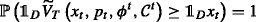

Definition 8

For any fixed t∈[0,T), we say that a trading strategy  is admissible if the discounted wealth \(\widetilde {V}_{u}\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) is bounded from below by a constant. We denote by \( \Psi ^{t,x_{t}}(p_{t},\mathcal {C}^{t})\) the class of admissible strategies corresponding to \(\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) and we denote by

is admissible if the discounted wealth \(\widetilde {V}_{u}\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) is bounded from below by a constant. We denote by \( \Psi ^{t,x_{t}}(p_{t},\mathcal {C}^{t})\) the class of admissible strategies corresponding to \(\left (x_{t},p_{t},\phi ^{t},\mathcal {C}^{t}\right)\) and we denote by

the class of all admissible trading strategies on [t,T] relative to the class  of contracts for the hedger with the initial endowment x

t

at time t. In particular,

of contracts for the hedger with the initial endowment x

t

at time t. In particular,  is the class of all trading strategies that are admissible for the hedger with the initial endowment x at time t=0.

is the class of all trading strategies that are admissible for the hedger with the initial endowment x at time t=0.

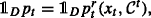

3.3 No-arbitrage with respect to the null contract

A minimal no-arbitrage requirement for an underlying market model is that it should be arbitrage-free with respect to the null contract. Note that, consistently with Assumption 3 and the concept of replication (for the general formulation of replication of a non-null contract, see Definition 18), it is implicitly assumed in Definition 10 that the price at which the null contract is traded at time zero equals zero. Needless to say, this is a rather indisputable feature of any trading model.

Definition 9

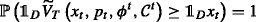

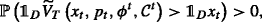

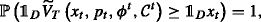

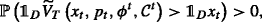

Consider an underlying market model  An arbitrage opportunity with respect to the null contract (or a primary arbitrage opportunity) for the hedger with an initial endowment x is a strategy \((x,0,\varphi, \mathcal {N}) \in \Psi ^{0,x}(0, \mathcal {N})\) such that

An arbitrage opportunity with respect to the null contract (or a primary arbitrage opportunity) for the hedger with an initial endowment x is a strategy \((x,0,\varphi, \mathcal {N}) \in \Psi ^{0,x}(0, \mathcal {N})\) such that

Definition 10

If no primary arbitrage opportunity exists in the market model \(\mathcal {M}\) then we say that \(\mathcal {M}\) has the no-arbitrage property with respect to the null contract for the hedger with an initial endowment x.

For an arbitrary linear market model, Definition 10 reduces to the classical definition of an arbitrage opportunity. It is well known that the no-arbitrage property introduced in this definition is a sufficiently strong tool for the development of arbitrage-free pricing for financial derivatives in the linear framework. This does not mean, however, that Definition 10 is sufficiently strong to allow us to develop nonlinear arbitrage-free pricing theory, which would enjoy the properties desirable from either mathematical or financial perspective.

On the one hand, a natural definition of a hedger’s fair value (see Definition 15) is consistent with the concept of no-arbitrage with respect to the null contract and thus it seems to be theoretically sound. On the other hand, as we argue below, Definition 10 is manifestly not sufficient to ensure an efficient valuation and hedging approach in a general nonlinear market for the following reasons. First, it may occur that the replication cost of a contract does not satisfy the definition of a fair price, since the possibility of selling of a contract at the hedger’s replication cost may generate an arbitrage opportunity for him. An explicit example of a market model, which is arbitrage-free in the sense of Definition 10, but suffers from this deficiency, is analyzed in Section 4.2.3. Second, and more importantly, there are no well established methods of finding a fair price in a general nonlinear market that satisfies Definition 10.

We contend that the drawback of the definition of an arbitrage-free model with respect to the null contract is that it does not make an explicit reference to a class  of contracts under study. Indeed, it hinges on the specification of the class \(\Psi ^{0,x}(0, \mathcal {N})\) of trading strategies, but it makes no reference to the larger class

of contracts under study. Indeed, it hinges on the specification of the class \(\Psi ^{0,x}(0, \mathcal {N})\) of trading strategies, but it makes no reference to the larger class  To amend that drawback of Definition 10, it was proposed in Bielecki and Rutkowski (2015) to consider the concept of the no-arbitrage property for the trading desk with respect to a predetermined family

To amend that drawback of Definition 10, it was proposed in Bielecki and Rutkowski (2015) to consider the concept of the no-arbitrage property for the trading desk with respect to a predetermined family  of contracts.

of contracts.

3.4 No-arbitrage for the trading desk

Following Bielecki and Rutkowski (2015), we will now examine a stronger no-arbitrage property of a market model, which is intimately related to a predetermined family  of financial contracts. Our goal is here to propose a more stringent no-arbitrage condition, which not only accounts for the nonlinearity of the market, but also explicitly refers to a family of contracts under consideration. Regrettably, the class of models that are arbitrage-free in the sense of Definition 14 seems to be too encompassing and thus it is still unclear whether the valuation irregularities mentioned in the preceding section will be completely eliminated (for an example, see Section 4.2.3).

of financial contracts. Our goal is here to propose a more stringent no-arbitrage condition, which not only accounts for the nonlinearity of the market, but also explicitly refers to a family of contracts under consideration. Regrettably, the class of models that are arbitrage-free in the sense of Definition 14 seems to be too encompassing and thus it is still unclear whether the valuation irregularities mentioned in the preceding section will be completely eliminated (for an example, see Section 4.2.3).

For simplicity of notation, we consider here the case of t=0, but all definitions can easily be extended to the case of any date t. The symbols \(\mathcal {X}=\mathcal {X} (A)\) and \(\mathcal {Y}=\mathcal {Y} (- A)\) are used to emphasize that there is no reason to expect that the trading adjustments will satisfy the equality \(\mathcal {X} (-A)= -\mathcal {X} (A)\), in general. Therefore, we denote by \(\mathcal {Y}=\left (Y^{1}, \dots, Y^{n}; \alpha ^{1}(\mathcal {Y}), \ldots, \alpha ^{n}(\mathcal {Y}); \beta ^{1}(\mathcal {Y}), \ldots, \beta ^{n}(\mathcal {Y})\right)\) the trading adjustments associated with the cumulative cash flows process −A. In order to avoid confusion, we will use the full notation for the wealth process, for instance, \(V(x,p,\phi,\mathcal {C})=V(x,p,\phi, A,\mathcal {X})\), etc.

Remark 2

As already mentioned above, it is not necessarily true that the equality Yk=−Xk, holds for all k=1,2,…,n. For instance, this equality is satisfied by the variation margin, but it is not met by the initial margin and the regulatory capital, which are always non-negative.

Definition 11

For a contract \(\mathcal {C}=(A,\mathcal {X})\) and an initial endowment x, the combined wealth is defined as

where x1,x2 are arbitrary real numbers such that \(x=x_{1}+x_{2},\phi \in \Psi ^{0,x_{1}}(0,A,\mathcal {X}),\) and \(\, \bar \phi \in \Psi ^{0,x_{2}}(0,-A, \mathcal {Y})\). In particular, \({{V}^{\text {com}}_{0}}(x_{1}, x_{2},\phi, \bar \phi, A,\mathcal {X},\mathcal {Y})\,=\, x_{1} \!+x_{2}=x\).

The rationale for the term combined wealth is fairly transparent, since it comes directly from the financial interpretation of the process given by the right-hand side in (30). We argue below that it represents the aggregated wealth of the two traders, who are members of the same bank trading desk, and who are supposed to proceed as follows:

-

The first trader takes the long position in a contract \((A,\mathcal {X})\), whereas the second one takes the short position in the same contract, so that his position is formally represented by \((-A, \mathcal {Y})\). Since we assume that the long and short positions have exactly opposite prices, the corresponding cash flows p and −p coming to the trading desk (and not to individual traders) offset each other and thus the initial endowment x of the trading desk remains unchanged.

-

In addition, it is assumed that after the cash flows p and −p have already been netted, so they are no longer relevant, the initial endowment x is split into arbitrary amounts x1 and x2 meaning that x=x1+x2. Then each trader is allocated the respective amount x1 or x2 as his initial endowment and each of them undertakes active hedging of his respective position. It is now clear that the level of the initial price p at which the contract is traded at time zero is immaterial for both hedging strategies and the total (i.e., combined) wealth of the two traders is given by the right-hand side in (30).

Alternatively, the combined wealth may be used to describe the situation where a single trader takes long and short positions with two external counterparties and hedges them independently using his initial endowment x split into x1 and x2. Of course, in that case it is even more clear that the initial price p does not affect his trading strategies since the amount of cash received at time 0 from one of the counterparties is immediately transferred to the second one.

Remark 3

One can also observe that the following equality holds for any real number p

where \(\widetilde {x}_{1}=x_{1}-p\) and \(\widetilde {x}_{2}=x_{2}+p\) is another decomposition of x such that \(x=\widetilde {x}_{1}+\widetilde {x}_{2}\). However, Eq. (30) better reflects the actual trading arrangements and it has a clear advantage that a number p, which is not known a priori, does not appear in the expression for the combined wealth. Hence, (30) emphasizes the crucial feature that the combined wealth is independent of p. In fact, one can remark that the fact whether the trading desk is aware about the actual level of the price p is immaterial for the question whether an arbitrage opportunity for the trading desk exists in a particular market model.

Definition 12

A pair \((x_{1},\phi ; x_{2}, \bar \phi)\) of trading strategies introduced in Definition 11 is admissible for the trading desk if the discounted combined wealth process

is bounded from below by a constant. The class of strategies admissible for the trading desk is denoted by \(\Psi ^{0,x_{1},x_{2}}(A,\mathcal {X}, \mathcal {Y})\).

We are in a position to formalize the concept of an arbitrage-free model for the trading desk with respect to a particular family of contracts.

Definition 13

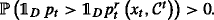

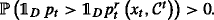

A pair \((x_{1},\phi ; x_{2},\bar \phi) \in \Psi ^{0,x_{1},x_{2}}(A,\mathcal {X}, \mathcal {Y})\) is an arbitrage opportunity for the trading desk with respect to a contract \((A,\mathcal {X})\) if the following conditions are satisfied

Definition 14

We say that the market model  has the no-arbitrage property for the trading desk if there are no arbitrage opportunities for the trading desk with respect to any contract \(\mathcal {C} \) from

has the no-arbitrage property for the trading desk if there are no arbitrage opportunities for the trading desk with respect to any contract \(\mathcal {C} \) from  .

.

Our main purpose in Sections 3.3 and 3.4 was to provide some simple and financially meaningful criteria that would allow us to detect and eliminate market models in which some particular form of arbitrage appears. Definition 10 and Definition 14 provide such criteria for accepting or rejecting any tentative nonlinear market model. It is easy to see that a model which is rejected according to Definition 14 will also be rejected if Definition 10 is applied. We do not claim, however, that these tentative tests are sufficient for an effective discrimination between acceptable and non-acceptable nonlinear models for valuation of derivatives. Therefore, in Definition 19, we will formulate additional conditions that should be satisfied by an acceptable model, which is then called a regular model.

3.5 Dynamics of the discounted wealth process

It is natural to ask whether the no-arbitrage for the trading desk can be checked for a given market model. Before we illustrate a simple verification method for this property, we need to introduce additional notation. Let us write

Lemma 2

The discounted combined wealth satisfies